SEI is showing renewed strength after confirming a breakout from an inverse head and shoulders pattern.

According to data from crypto.news, Sei (SEI) surged over 26% on July 11 to reach a six-month high of $0.33, before settling at $0.32. The token remains up approximately 113% from its lows last month.

Its market capitalization now stands at $1.78 billion, ranking it as the 70th largest digital asset, while daily trading volume jumped by over 200%, reflecting a sharp increase in market participation.

SEI’s price surged after the team announced that the network will soon support native USDC, issued directly by Circle, the issuer of the most widely regulated and institutionally adopted stablecoin.

The announcement also confirmed the upcoming integration of Circle’s Cross-Chain Transfer Protocol (CCTP). This will allow users to move USDC seamlessly between Sei and other major chains like Ethereum, Solana, and Avalanche, without relying on third-party bridges or wrapped assets.

These integrations significantly enhance Sei’s value proposition by enabling fast, secure, and cost-efficient capital flows across ecosystems. Native USDC on Sei can power more efficient global payments, deepen liquidity across DeFi protocols, and lay the groundwork for institutional-grade financial applications.

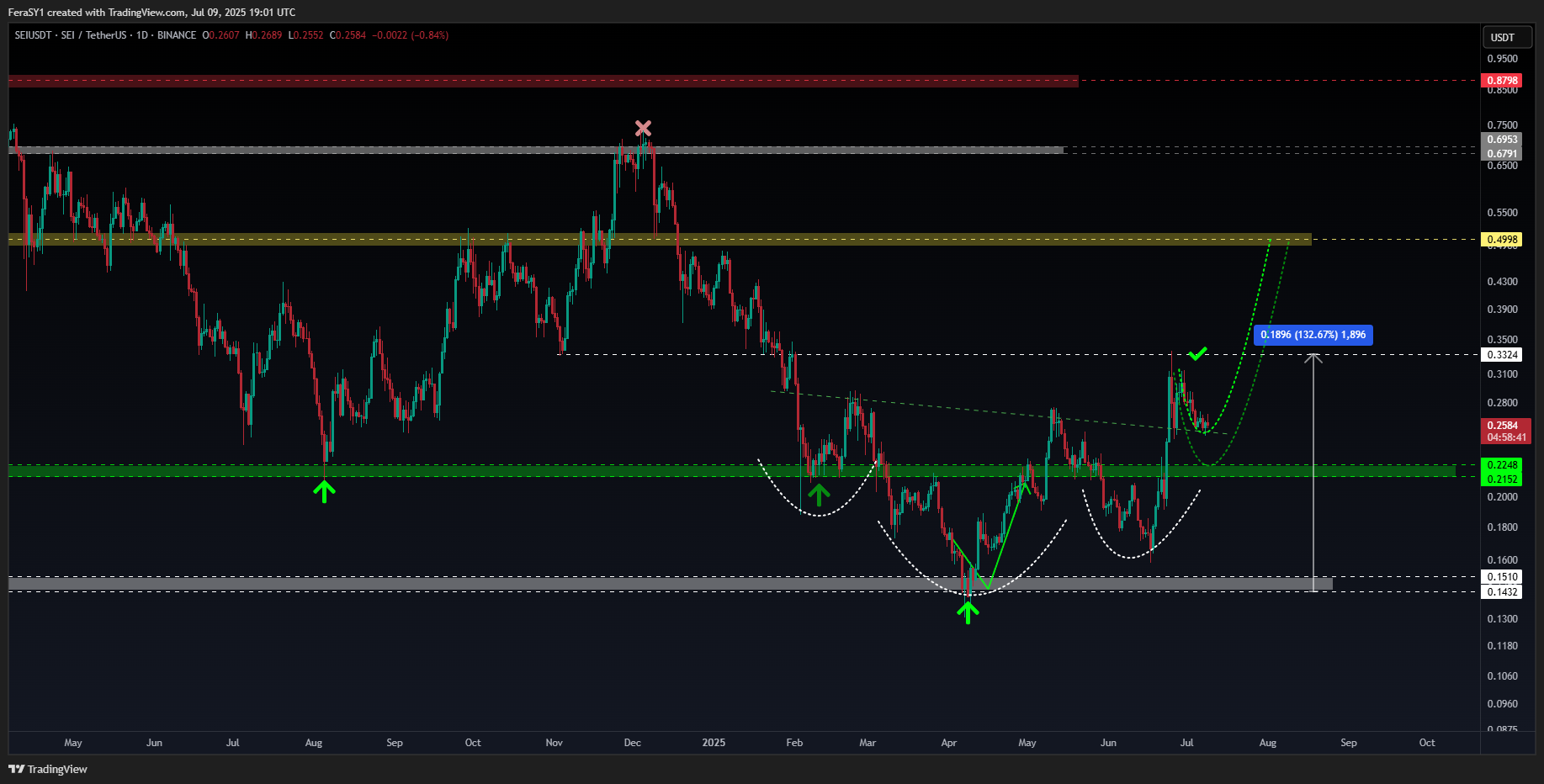

The significant surge in trader interest and sustained buying pressure helped SEI break out of a well-defined inverse head and shoulders pattern on the daily chart. The neckline, positioned between $0.26 and $0.27, was decisively breached, and a successful retest has confirmed the validity of the breakout.

According to pseudo-anonymous analyst Crypto Feras, the breakout projects an upside target of approximately $0.499, based on a measured move from the pattern’s base near $0.15. As of press time, this target remains nearly 55% from the current price level.

Bullish sentiment is also being echoed by other market analysts, with some projecting that SEI could reach as high as $1.50 by year-end, should macro and ecosystem developments remain favorable.

Multiple bullish catalysts in play

Momentum indicators seem to favour a continuation of the rally at least in the short term. The MACD line has crossed above the signal line, and RSI has continued to trend upward. This means buyers are currently dictating short-term price action..

Adding to that, derivatives data further supports this outlook. According to CoinGlass, open interest in SEI futures has surged by more than 210% over the past three weeks, rising from under $50 million in mid-June to approximately $318 million as of press time. Traders are likely positioning themselves in anticipation of a breakout.

Meanwhile, data from DeFiLlama shows total value locked across Sei’s DeFi protocols has reached a new all-time high of $1.4 billion. The scale of capital inflow points to sustained user activity across decentralised applications beyond just speculative interest in the SEI token alone.

As more liquidity anchors into the network, Sei stands to benefit from deeper markets, greater pricing stability, and improved conditions for developers building DeFi infrastructure.

Further support for Sei’s growth outlook may come from institutional positioning. Circle’s IPO prospectus, filed recently with U.S. regulators, confirms a holding of 6.25 million SEI tokens. This level of exposure suggests that Circle views Sei as a meaningful component in its broader blockchain strategy.

Moreover, Sei is currently one of eleven blockchain networks under review by the Wyoming Stable Token Commission for the upcoming WYST stablecoin project. A final decision is expected on July 17.

Should Sei qualify for the selection, it would mark another big step toward regulatory alignment and could further reinforce the network’s credibility as a compliant, institution-ready blockchain infrastructure in the U.S.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.