The FOMC May 2025 rate decision could shake Bitcoin, SPX, and even top Solana meme coins. Will Powell’s pause or cut spark a crypto rally?

The Federal Open Market Committee (FOMC) will conclude its two-day meeting on May 7 before announcing whether its findings justify a rate cut, hike, or maintaining rates at 4.50%.

DISCOVER: 20+ Next Crypto to Explode in 2025

Eyes on the Federal Reserve

Forty-five minutes after the rate decision is announced, Jerome Powell, FOMC Chair, will hold a press conference, fielding questions from journalists.

While rate announcements often trigger crypto price volatility, the Powell presser often moves the market.

Inevitably, questions about the decision will be raised. His answers will give analysts insights into the FOMC’s monetary policy direction for the coming months.

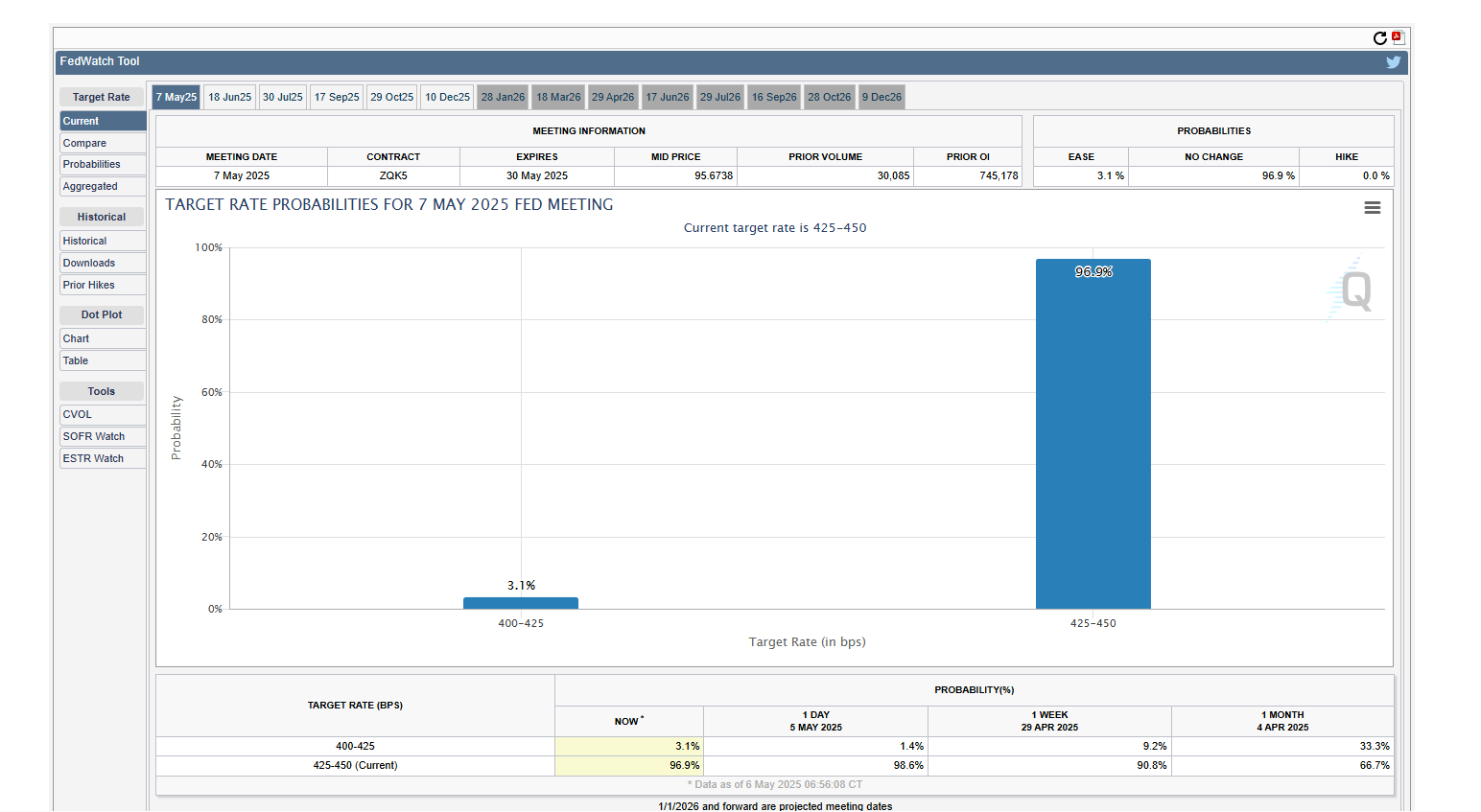

There is a 97% probability of no rate change at 4.50%, looking at the CME FedWatch Tool.

(Source)

However, if the FOMC yields to pressure and cuts rates, crypto and Bitcoin prices could surge. The S&P 500 (SPX) might also extend gains above $6,000, channeling more capital into equities.

Some of the best cryptos in the top 30 could break local resistance levels, pushing the total market cap firmly above $3 trillion.

Conversely, maintaining or hiking rates could deliver a severe blow to Bitcoin and even some of the best meme coin ICOs to invest in May.

The Interest Rate Pause

If economists’ forecasts hold and the FOMC votes to keep rates steady, it will be the third consecutive meeting without a rate change.

The last rate cut was in December 2024, when the central bank lowered rates from 5.5%.

In the previous meeting, Powell justified the pause, citing the resilience of the U.S. economy.

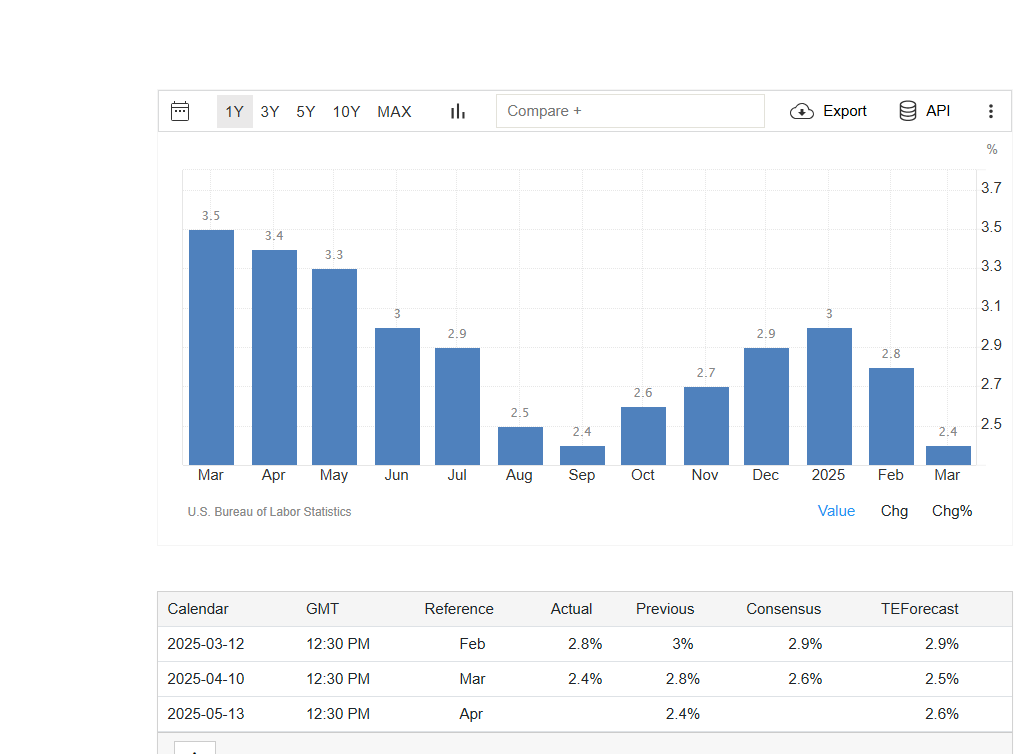

He noted that the labor market remains strong and inflation is moderating, though it stands at 2.4% year-on-year, above the 2% target.

(Source)

The lack of clear forward guidance on future cuts disappointed investors hoping for a dovish environment conducive to SPX and crypto bulls to thrive.

Powell emphasized that the FOMC seeks “greater clarity,” mindful of inflation and economic pressures from Donald Trump’s tariff policies.

Without major trade deals following the 90-day tariff pause, inflation forecasts remain elevated.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in May 2025

SPX Surge Mirrors Crypto Boom: What’s Next?

SPX prices bottomed at $4,837 in early April before surging after Donald Trump announced a 90-day tariff pause to allow negotiations.

A trade deal with China could significantly lift SPX, potentially pushing prices above $5,800 in a bullish trend continuation pattern.

(SPX)

In early May, China announced tariff exemptions for 25% of U.S. imports.

Kevin O’Leary, also known as Mr. Wonderful, stated that a major deal would stabilize markets and reassure investors, noting that “China is a different kettle of fish.”

Everybody would like to see deal one inked. Deal one would calm the markets, calm my investors, and calm all the companies I’ve invested in.

China is a different kettle of fish. They are not a tariff problem, they steal IP, they don’t give us access to their markets, and they… pic.twitter.com/sv6vZidnpu

— Kevin O’Leary aka Mr. Wonderful (@kevinolearytv) May 1, 2025

Bitcoin and crypto prices could also rally, with BTC surging above $100,000, propelling other top cryptos to new valuations; a relief after the Q1 2025 hammering.

DISCOVER: Top Solana Meme Coins 2025: 7 Best Buys Updated

FOMC Meeting: Will SPX and Bitcoin Rally Or Dump?

- The Federal Reserve May 7 rate decision is in focus, will the central bank slash rates?

- Powell will lift or trigger a sell-off in SPX and equities

- Economists predict rates to steady at 4.50%

- Will Bitcoin extend gains and breach $100,000?

The post FOMC Meeting Halts SPX Recovery: Can Crypto Weather No Rate Cut from Powell? appeared first on 99Bitcoins.